Are your customers using your product to its fullest potential? Chances are they’re not — and that’s dangerous for your bottom line.

One major reason customers stop using a product is because they’re not experiencing its full value. If they don’t understand your full feature set or aren’t sure how to use the tools in innovative ways, they aren’t as likely to stick around.

But how do you increase adoption and stickiness of your product? You tell them how to use it in your content.

Content can be a powerful tool for reducing customer churn when:

- You’re certain your customers are the right ones

- Your product is good

- Your customer service is solid

Why Content Marketing Isn’t Just for Generating Leads

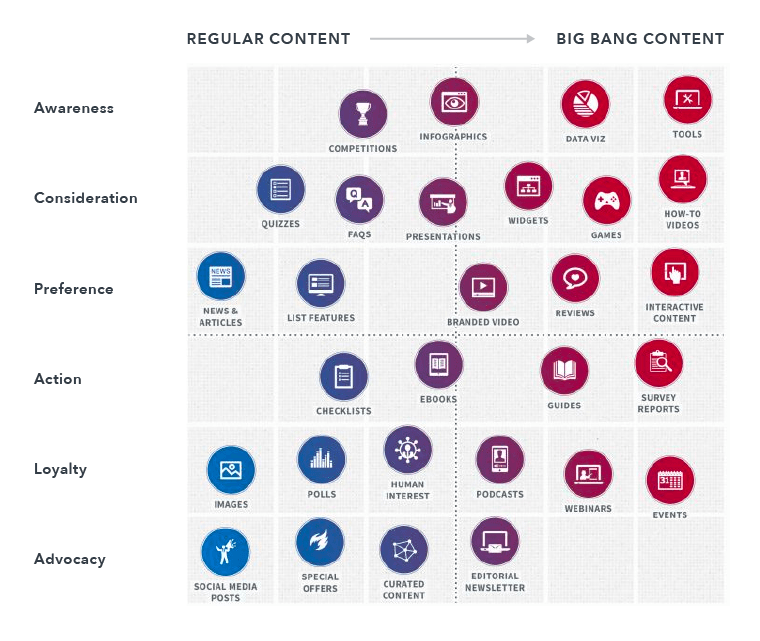

When most of us think about content marketing, we think of its role at the beginning of your relationship with your customers — while they’re still prospects in search of a solution to their problem. There it captures attention, generates leads, and helps them through their decision-making process.

When used correctly (think: right content, right place, right time), content can engage and educate your prospects through their entire purchasing process. But its role later in the customer journey is just as (probably more) important.

That’s because content is also really great at helping delight customers. In fact, that’s where it can be most helpful to your customers and your bottom line.

In 2013 it was predicted that by the end of 2020, a customer’s experience would overtake a product’s price and performance as the reason for customer loyalty. Today more than 52% of consumers say they would pay more for an improved customer experience.

What Content Does for SaaS Customers

From onboarding to self-supporting, content can help customers get more value from your product with less friction.

What Content Does for You

For SaaS companies, content can encourage additional use cases, answer questions quickly, and help customers feel supported. This keeps customers delighted, increasing stickiness and increasing referrals, upsells, and cross-sells.

At the end of the day, the key to SaaS growth is a happy customer. Customers that love your product and your company will not only stick around, they’ll also attract more customers just like them.

7 Ways to Use Content to Delight Your Customers

But how do you use content to reduce customer churn? Create an experience that ensures your customers are getting the most value out of your product.

Let’s take a look at seven types of customer-focused content that help companies manage churn through customer experiences that encourage long-term use of their product.

1. Build an Online Community

Many companies host private online communities to give their customers a place to inspire other customers. These groups often begin on simple platforms like Facebook, LinkedIn and

Slack. As they grow, some companies elect to move them to a more robust platform or create their own.

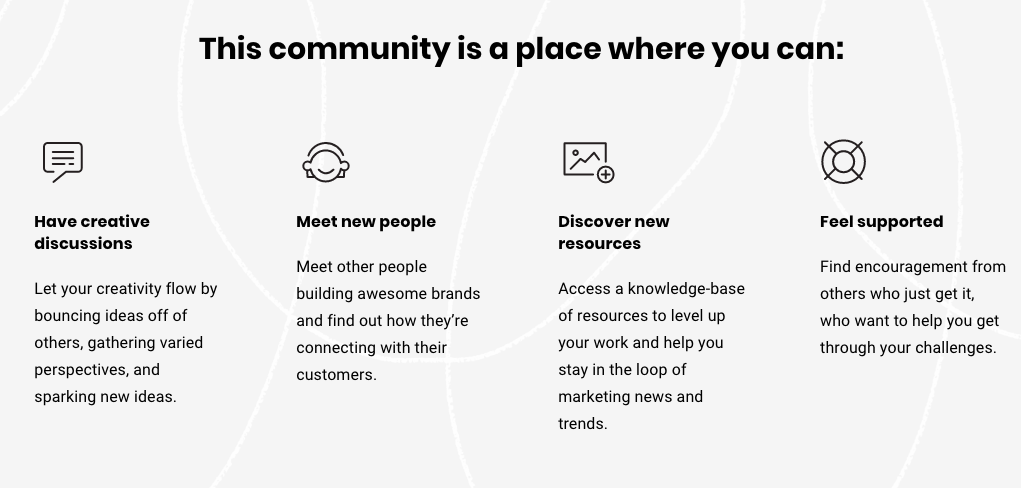

For example, Sketch, a vector graphics editor platform invites their designers to connect, share knowledge, and learn more about their application.

Similarly, Buffer, a platform that helps users manage, schedule, and track social media posts, hosts a community dedicated to creative discussions and the discovery of new resources and ideas.

These communities are friendly, searchable, and full of helpful information and innovative ways for customers to use their products.

2. Create a User Group

Today’s challenge: Help your customers achieve their desired outcome. If you do, your customers will be much more likely to continue to use your product and remain loyal to your brand. Some companies are doing that with a hands-on user groups.

User groups are a place where your customers with similar interests and goals can meet face-to-face. At HubSpot User Group meetings, for example, members share product updates and best practices, and provide training opportunities for their local user communities. Sometimes, HubSpot employees even present in person.

Fun fact: HubSpot’s annual INBOUND conference grew out of this program.

3. Produce Knowledgebase Content

One of the biggest hurdles to success your customers face can be learning to use your product. Try helping them get over it with user-friendly knowledgebase content. Video, for example, is a great way to communicate new or complex ideas with your customers — especially if they’re just getting started with your solution.

Help Scout, a help desk software provider, created a series of short videos to help its users onboard and train their team quickly and efficiently. In their first video, they provide viewers a quick overview of how to manage conversations in their reply editor. At the end, they invite them to continue their learning by attending a live demo.

4. Launch a Training Program

Unless they’re what you might consider a seasoned pro, chances are your customers are not getting all they can out of our product. To help them level-up their skills, companies have started to create certifications and training programs to both establish and promote expertise among their users.

SemRush academy offers a generalized digital marketing program where students can enroll in free courses on topics like SEO, PPC, and content marketing. When complete, learners receive a certification, and share their credentials with their network.

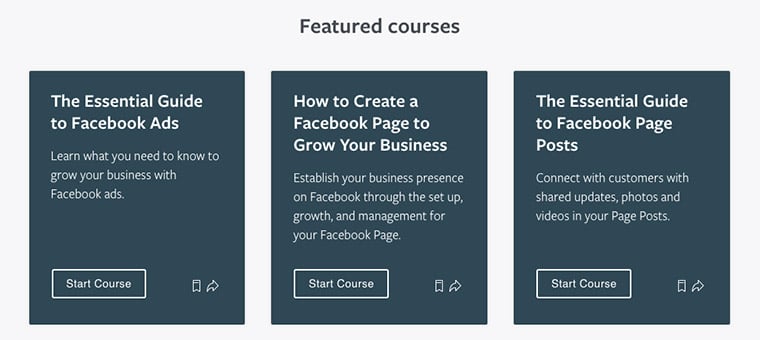

Similarly, Facebook Blueprint helps customers learn how to grow digitally, but their content is created specifically for Facebook. Its featured courses cover topics like How to create an Ad on Facebook and Growing Your Business with Instagram: What You Need to Know.

5. Write a Case Study

With the SaaS market experiencing such wild growth and expansion in the last decade, there is no surprise that competition is on the rise. The key to success is to differentiate your product and continually position yourself as the right solution.

You can do this easily with case studies. They’re designed to show a wide range of product use cases and best practices for success. Plus, you might already have them as a tool in your arsenal.

6. Customer awards

The days of lock-them-in contracts are over. Instead, customers hold all the power: If they’re not happy, they’ll leave. To speak to their deepest emotions, you might consider rewarding them for being innovative and loyal users of your product. Skilljar does this annually with its Golden Skillet Awards.

Creating a customer award system is also a great incentive for your users to dig in deeper with your products to learn them and use them in new and interesting ways.

7. Deliver Regular Updates

Show your customers you are continually at the leading edge of innovation by regularly releasing information about your latest updates and/or integrations.

Wistia and Todoist do this regularly on their product update blog, giving customers insider information on how to best use and get the most out of their tools’ newest features.

Customers who engage more leave less

Companies help their users learn to navigate their products in many ways as part of their customer success management strategy. From podcasts to YouTube, the more customers engage with your product, the less likely they’ll be to leave. But, reducing SaaS churn takes more than just producing content.

You must go above and beyond to provide a truly exceptional experience.

- Anticipate your customers’ questions

- Answer them using the right form of content

- Put the content where they will find it

If you can make your product “sticky” through better content your customers will stay longer, spend more, and sing praises to their peers.